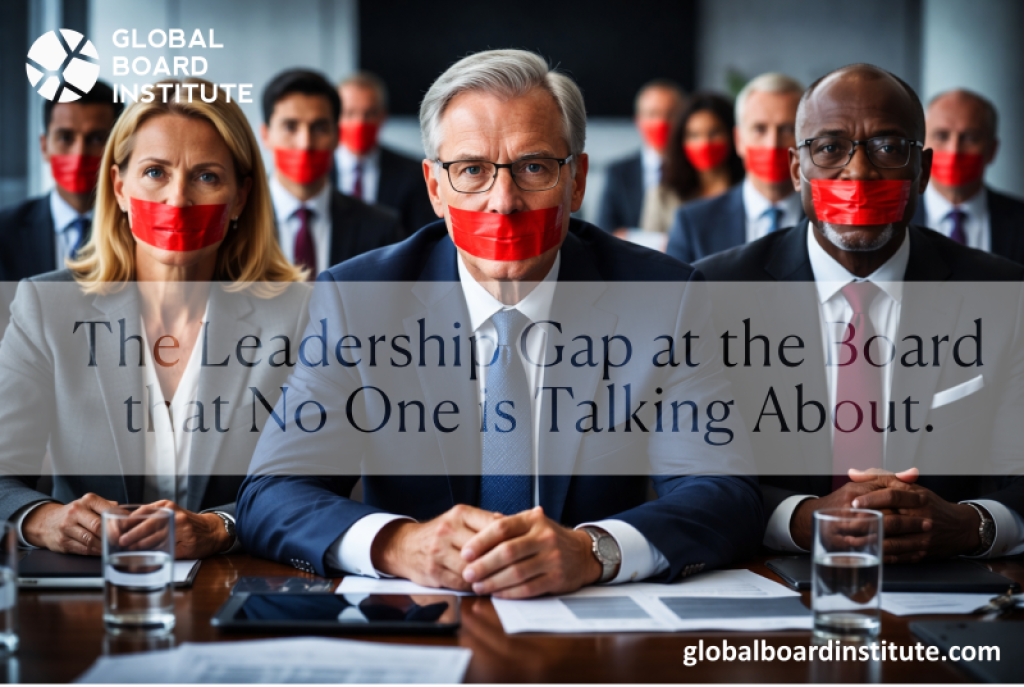

Boards sit at the apex of organizational accountability. New evidence suggests that many are not fully delivering on their potential to create value. How do Directors themselves perceive board effectiveness and where are boards falling short?

Across geographies, sectors, and ownership structures, a consistent theme is emerging: boards want to add more value, but many are structurally and behaviourally constrained from doing so.

Here are the three most important insights every board should reflect on...

Insight 1: Most Boards Are Leaving Value on the Table

While boards are legally compliant and operationally active, many directors do not believe their boards are operating at full potential. Only a minority of respondents described their boards as an essential value-creation tool. The majority acknowledged room for improvement in how boards operate, prioritize discussions, and support executive decision-making

This gap is not about lack of commitment. On the contrary, directors care deeply about impact. The issue lies in how board time is used. Too many meetings are dominated by backward-looking reports, dense papers, and compliance-driven agendas, leaving insufficient space for strategic dialogue, challenge, and foresight.

Private company boards often reported higher perceived value contribution, largely due to clearer mandates, faster decision-making, and fewer regulatory constraints. Public company boards, by contrast, are frequently tied down with compliance obligations that dilute strategic focus.

The takeaway: If directors leave meetings wondering whether their time was well spent, the board is underperforming, regardless of experience or reputation.

Insight 2: Boards Are Underprepared for Risk, Cybersecurity, and AI

Risk oversight remains one of the board’s most critical responsibilities, yet confidence levels are uneven. A significant proportion of directors lack confidence in their board’s ability to respond to a major cybersecurity incident. Even more concerning, nearly half of boards had conducted at most one cyber simulation in the past two years.

AI presents an even deeper challenge. More than half of boards discuss AI only periodically or reactively. Several panellists emphasized that AI is not “just another technology,” but a structural force reshaping business models, talent, governance, and risk itself. Most importantly, AI Governance is still not fully owned by the board, indicating a lack of clarity on how to move forward on that front.

Boards face two compounding risks:

- Information overload (long risk registers, dashboards without insight),

- False reassurance driven by familiarity (“we talk about cyber all the time, so we must be covered”).

The most effective boards are moving beyond reporting to simulation, deep dives, and forward-looking risk conversations, ensuring risk oversight becomes a source of strategic advantage rather than anxiety.

The takeaway: Boards cannot delegate understanding of cyber and AI risk. They must actively govern, rehearse, question, and anticipate.

Insight 3: Board Evaluation and Development Are Treated as Signals, Not Performance Tools

Nearly all directors admit they would conduct board evaluations even if not required. Yet, half admitted they see evaluations primarily as proof of good governance rather than as tools for improving board performance. Similarly, around 60% of boards rely on ad-hoc or reactive board development rather than structured, continuous improvement.

This creates a paradox: boards acknowledge the need to improve but fail to institutionalize learning, a clear KPI for the NRC (Nominations & Renumerations Committee.)

Effective board development starts with individual responsibility, directors owning their own capability gaps, but it must also be systemic. High-performing boards use evaluations to:

- Diagnose where value is lost

- Shape annual agendas

- Target skill gaps

- Design and implement Director Development plans

- Improve decision quality over time

Without this discipline, boards risk stagnation, even as external complexity accelerates.

The three most needed knowledge gaps in the market currently today are:

- Corporate Governance - 67% of board directors said they do not have formal governance training or qualification.

- AI Governance - only a handful of boards had only one director on the board who understood AI Governance.

- ESG Qualification - 89% of Boards say they do not have an ESG Director Seat, even though ESG as a topic is on the agenda.

The takeaway: A board that does not intentionally develop itself will steadily lose relevance—no matter how experienced its members are.